ATTENTION: First home buyer

Get Into Your First Home

(Without the Guesswork)

The First Home Accelerator by Mint Loans

Paying someone elses mortgage or still living at home?

What if you could get the keys to your own home instead - with no stress or confusion?

We've made it simple

🎓 Mortgage Broker | Dip. Finance & Mortgage Broking, Piers Shumack (Credit Representative No. 551892)

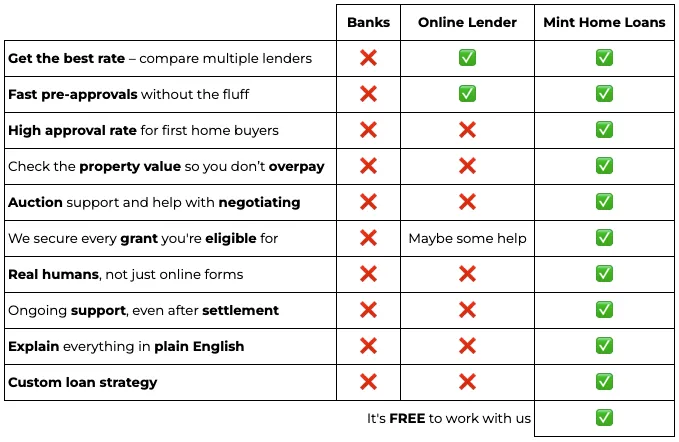

First Home Buyer - What You’re Getting VS What You’re Missing

Don’t Take My Word For It...

Martin I.

“I recently engaged Mint Home Loans to aid in the procurement of an investment property via SMSF. Piers was very knowledgeable on the subject matter and tailored a solution suitable to my current situation and needs. His professionalism, promptness in replies and personable nature was very commendable.”

Jakob D.

“Piers was incredibly proactive and went above and beyond, a treasure to deal with and really insightful. Now we have our Investment loan done, we're heading back to revise our retirement plan and begin the process with Mint home loans on our SMSF.”

Carina M.

“We recently engaged Piers from Mint Home Loans, and was thoroughly impressed with the level of service he provided throughout the process. He demonstrated a deep understanding of the market and was able to guide me towards a mortgage solution that perfectly aligned with our financial goals.”

These Questions Don’t Go Away – Until You Get a Real Plan

How much can I actually borrow?

What if I don’t get approved?

How do the government schemes actually work?

Do I need 5%, 10%, or 20% deposit?

Where should I buy? Who can I trust?

Are real estate agents even telling me the truth?

What are the real costs of buying – and what’s just noise?

Can I even buy at auction without stuffing it up?

Will I lose my deposit if I make a mistake?

What is stamp duty, and do I have to pay it?

What’s a conveyancer and how do I find a good one?

Is my credit history going to ruin this for me?

I’m casual at work – can I still buy?

From Overwhelmed to Homeowner

Here’s the Game Plan

Step 1

Get Loan-Ready

Without the Headache

30-minute strategy call

Post call strategy report & checklist

Clean up your documents

Review your budget guide

Get you pre-approved without all the fluff

Know exactly what you can afford before you start looking

Step 2

Find the Right Property

Without Getting Burnt

Help you search smarter, not harder

Give you real property reports that actually mean something

Guide you through every open home, auction, and “I think this is the one” moment

Step 3

Get the Keys

With a Game Plan

Help you make educated offers

Give you smart negotiation tools

Support through to settlement day and beyond.

Emily Came In Confused. She Left With a Plan.

Loan amount $450,000, Unit in Queanbeyan NSW.

Emily H. came in with $21K and no clue if she could buy solo.

We built a plan, used the First Home Buyer Guarantee, and 4 months later – she had keys in hand.

What We Actually Did for Emily

Built multiple loan strategies

Connected her with a trusted conveyancer in Canberra

Provided detailed property reports

Secured a fantastic rate with zero LMI

Stayed in her corner the entire way - to this very day